About to Retire

I am just about to retire and need to take the right steps to make that happen

Retired

I am retired and I need a strategy to help me not outlive my money or become financially dependent

on others

It all starts with a Plan

Your team helps clarify and define your vision of retirement success through active conversation, listening to your concerns and understanding what keeps you up at night. Our holistic and objective view will help you ask the right questions and make the right decisions with respect to your financial goals and concerns. Our process covers a wide range of retirement related issues including, retirement spending, estate and legacy planning, tax efficiency, long term care, and social security.

Professional Investment Management

Successful investing requires research, time, process, and discipline to do it right. We take responsibility for the day-to-day management of your accounts… so you can concentrate on what you like to do.

Ongoing Guidance

There is nothing “set it and forget it” about your life, or a successful retirement. Families change, markets change, health conditions change. We are there for you and your family, providing decision support, reviewing progress, making enhancements, and planning for the coming year. Perhaps even more importantly, we are here to keep you on track emotionally so that your Plan stays on track too.

Retirement Income Management

In general, retired investors have less risk tolerance and as mentioned before, the inability to take advantage of systematic contributions (dollar cost averaging). There is an understandable feeling of vulnerability – in that if their accounts are wiped out they are in a potentially terrible situation. So the tradeoff between growth and volatility changes. Without some stock exposure, and the volatility which comes with it, there is a risk that minimal portfolio growth will cause inflation to decrease spending in real terms. With too much volatility, retirees are subject to too much stress.

For retirees, we typically use some of the following techniques:

We keep interest rate risk low

In an inflationary environment, interest rates also tend to rise. This can be detrimental to total bond investment returns. So in order to help control that risk, we typically user shorter term fixed income investments or managed accounts which will hedge some interest rate risk.

We diversify sources of income

As opposed to using just standard bond portfolios which can suffer during inflationary periods, we try to include other sources of income such as high dividend stocks, covered call strategies, REITs and senior loan investments.

We maintain liquidity

In comparison to accounts managed for younger clients, we tend to hold a little more cash in the portfolios and pay most income dividends to cash. In many cases, these income flows can cover a large part of the distribution needs. While we are still focusing on total return, keeping a cash buffer can help us avoid selling large amounts of assets in a down market just to generate cash.

We diversify

For retired investors it’s not about finding that one tech stock that is going to go to the moon. It’s about having a portfolio which can generate distributions…and stay ahead of inflation. So diversification is key. The lessons of 1999 and 2007 were not long ago, and in those sorts of markets diversification makes a difference.

Retirement Income Planning

The planning process for retirement is a little different than the planning we do earlier in a client’s career. Here’s how:

The Stakes and the fears are higher

Retirement income planning and management just has two outcomes: The client’s money outlives them or the client outlives their money. And while there is a funny and common fantasy about having the last check they write before the day they die bounce……that day is hard to predict This fantasy tends to be countered by a very real fear of living final years impoverished, vulnerable, or dependent upon others.

It is this fear which leaves retirees vulnerable to sales pitches about high cost and high commission annuities and other products promoted to solve this problem.

We are solving for inflation adjusted cash flow based on a set amount of assets

The goal of any retirement income planning and management process is to produce enough cash flow to cover inflation adjusted spending for the duration of the client’s life…with the least amount of risk. We don’t have the ability to increase savings rates to make up for a deficit. We have to take the assets which have accumulated and make it work. This involves balancing numerous components such as distribution rates, taxes, income sources, investment strategies and inflation protection.

Retirement spending is not constant

For planning purposes we plan and adjust for three types of spending: Essential spending (Living expenses), discretionary spending (Fun stuff) and long term care. We have noticed throughout the years that discretionary spending tends to actually increase the first few years of retirement as healthy retirees get out and do all those things they have been waiting for. As they get into their late mid to late 70’s discretionary spending tends to drop a bit and then drop a bit more in their 80’s. Near end of life, however, health care and/or long term care tends to ramp up.

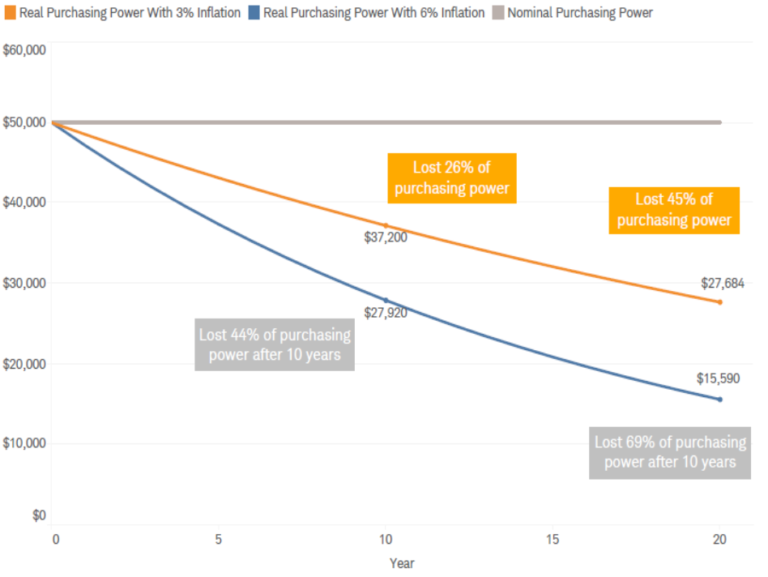

Inflation is a big risk

While soon to be retired people tend to focus on the swings of the investment markets as their biggest risk an even bigger risk is inflation. Even clients who own their own properties with low property tax rates are impacted by inflation in a big way……health care, food, utilities, maintenance costs go up over time. The chart below shows the corrosive effect of 3% and 6% inflation over 10 and 20 year periods.

An objective view of annuities

There are many different types of annuities. Some can fill an important role while many others are either partial or complete consumer rip offs. The problems are well documented….indecipherable contacts, high costs, misleading guarantees, low overall returns, long term lock up or surrender charges. Frankly though, the main sources of the annuity problem lies with the salespeople who sell them and the insurance companies who enable those salespeople. Masquerading as investment advisors, they use fear to sell vulnerable retirees products with high commissions and fees built in.

In some cases, however, annuity products can be a valuable tool to helping our clients maintain lifetime incomes. We have sophisticated software which can analyze different annuity products and also make adjustments in the overall strategies to accommodate those products. We also have the ability to evaluate existing annuity holdings for costs, returns, etc.

When an annuity product is needed, we have access to a range of commission free, lower cost alternatives.

Money is coming out….not going in

One of the advantages of 401(k) investing is the ability to take advantage of dollar cost averaging. That is the ability to automatically and systematically make contributions to an investment accounts as the markets are both rising and falling. As such, more shares are being purchased during a down cycle and less shares are purchased during an up cycle. It is a great way to boost long term returns. But the tables are turned for retirees. There are no more contributions being made so there is no way to take advantage of those down cycles. Instead, withdrawals often need to be made during down cycles. Risk and liquidity need to be carefully managed.

Contact Us

Address:

9696 Culver Blvd., Suite 301, Culver City, CA 90232

Telephone:

(310) 899-0606

Email:

info@fortress-wealth.com

Send us a Message

FORTRESS WEALTH MANAGEMENT, INC. ©2020 | Culver City, California | 310.899.0606

Farther Finance Advisors, LLC is an SEC-registered Investment Advisor. The material presented is for informational purposes only and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy or investment product. Investing in securities involves risks, including the potential loss of money, and past performance does not guarantee future results. For more details, see our disclosures in Form ADV Part 2. By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy.